Overview

The way we process cheques is now digital and here is everything you need to know about depositing cheques in the new way.

The image clearing system enables images of cheques to be exchanged between banks and building societies by using images of the cheque instead of moving paper to and from the UK for processing. This means your Sterling cheques will clear much faster.

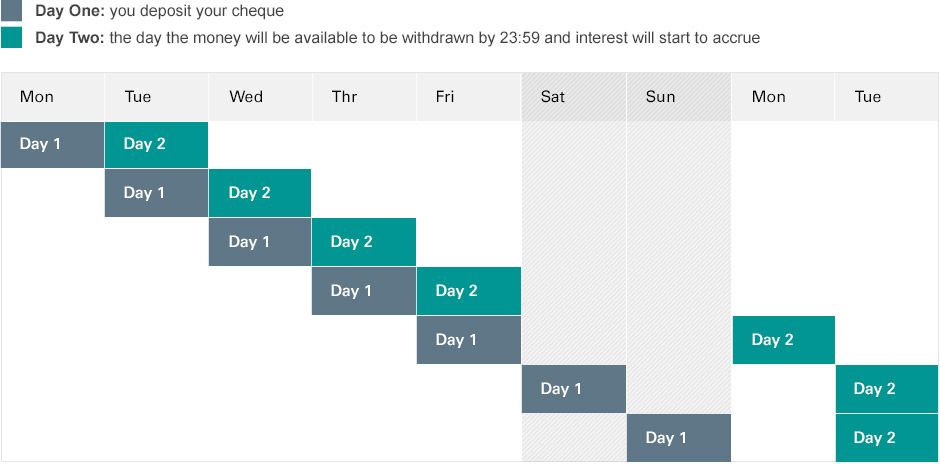

If you pay in a cheque on a weekday (before the cut off time) you will be able to withdraw the funds by 23:59 on the next weekday (provided the cheque doesn’t bounce).

Paperless transaction

An image of a paid in cheque will be taken, this image is the form of communication banks use to transfer cheque information between themselves, instead of the physical paper cheques previously used.Faster cheque clearance

Sterling cheques that are imaged will clear faster than they do today. Sterling cheques processed in this way will clear faster than they did previously.Access funds within 2 days

You will be able to access your funds within two working days.

Ways to deposit a cheque

Mobile banking

You can deposit up to £2,000 per cheque, with a daily limit of £2,000.

Branch

Cheques are to be deposited in branches or cheque deposit machines.

Posted to HSBC

You will receive your funds by 23:59 next working day once the item is received.

Important: To protect your funds we would continue to maintain our fraud checks as we do today.

Your bank statement

You will see a cheque on your statement once it has cleared. If it does not clear by 23.59 on the next working day the cheque has been returned unpaid and you will see a credit and debit cheque transaction. You will receive a letter to explain the reason why the cheque was unpaid.

Clearing cycle

Ensure you have funds available

You need to ensure you have sufficient funds when writing your cheques and until the cheque has debited your account, as it could be as quick as the next day. If there is not enough money to pay your cheque at the start of day we may try to pay it again at 1.30pm. If there is not enough money it may be returned unpaid. This will apply to all UK, Channel Islands and Isle of Man sterling bank cheques.

Cheque Imaging statement transactions

Paid cheques

Credit Transaction will appear on the account by 23:59 weekday after the cheque deposited.

Unpaid cheques

Credit and debit transactions will show on the account once unpaid decision has been received by 23:59 weekday after the cheques deposited and a letter will be sent advising the reason.

Represents

Credit and debit transactions will show on the account once unpaid decision has been received by 23:59 weekday after the cheques deposited and a letter will be sent advising the cheque will be represented for payment.