Explore our range of ready-made portfolios

Our professionally managed World Selection portfolios make it easy for you to invest in a diverse range of assets, whatever your risk level.

Choose from 5 pre-made portfolios and our specialists will make sure your investment stays within your chosen level of risk.

Key benefits

More reasons to invest

- Get started from £50 a monthUse our International Investment Centre to invest without advice and get started from £50 a month. Or invest with advice from £250 per month.

- Access your money anytimeMake withdrawals when you need to, as long as you keep at least £1,000 in each portfolio.

- Regular paymentsAs well as investing with a lump sum, you can set up monthly payments to grow your portfolio.

- Buy and sell whenever you likeOur online International Investment Centre is open 24/7, so it's easy to buy and sell, or view your portfolio.

Choose the portfolio that fits your risk level

The percentages shown may vary slightly. For the current breakdown see the factsheet.

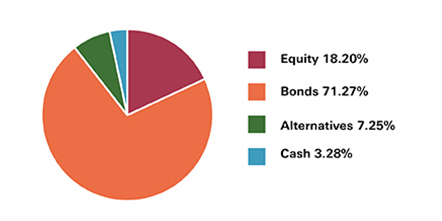

World Selection 1 - low risk[@world-selection-1]

This portfolio will mostly invest in or gain exposure to fixed income securities, company shares and alternatives including real estate, private equity and commodities. The fund usually has a significant bias towards investments with fixed interest strategies, with a maximum of 25% investment in or exposure to company shares.

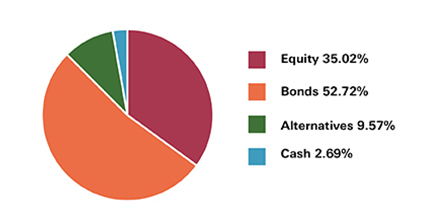

World Selection 2 - low to medium risk[@world-selection-2]

This portfolio will mostly invest in or gain exposure to fixed income securities, company shares and alternatives including real estate, private equity and commodities. Typically, the fund will have a bias towards investments with fixed interest strategies, but may have up to 50% investment in or exposure to company shares and up to 25% exposure in alternatives.

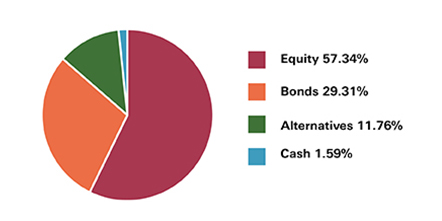

World Selection 3 - medium risk[@world-selection-3]

This portfolio will mostly invest in or gain exposure to fixed income securities, company shares and alternatives including real estate, private equity and commodities. The portfolio will hold at least 70% fixed income securities and company shares, and may gain exposure of up to 30% in alternatives.

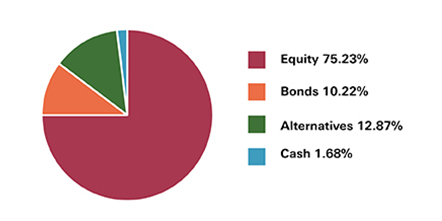

World Selection 4 - medium to high risk[@world-selection-4]

This portfolio will mostly invest in or gain exposure to fixed income securities, company shares and alternatives including real estate, private equity and commodities. The portfolio will hold at least 65% fixed income securities and company shares, and may gain exposure of up to 35% in alternatives.

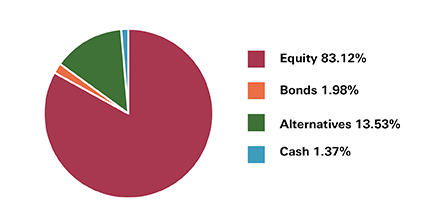

World Selection 5 - high risk[@world-selection-5]

This portfolio will mostly invest in or gain exposure to fixed income securities, company shares and alternatives including real estate, private equity and commodities. The portfolio will hold at least 55% fixed income securities and company shares with a bias towards shares, and may gain exposure of up to 45% in alternatives.

What's the difference between investing with or without advice?

Without advice

You can invest in World Selection portfolios without receiving advice from our wealth management team. Just go to our International Investment Centre to choose your portfolio and invest from £50 per month or a £500 lump sum. If you invest online, we won't assess whether the product you've chosen is suitable for you.

With advice

If you're not sure about investing or how much risk is right for you, you can invest in World Selection portfolios through our advised service. To receive advice you'll need to invest from £250 per month or a lump sum of £25,000. Find out more about our financial planning services.

Managing your investment

Once you've made your investment you can buy, sell and manage your investments through online banking, whether you received advice or not. All portfolios are monitored by our investment specialists to make sure they stay within the specified risk level.

Is there a charge to invest?

You may pay an initial charge to invest in the portfolio and an ongoing charge for the management of the portfolio. Depending on whether you invest through an advisor or through our International Investment Centre you may incur further charges on future transactions.

Things to know

Who can apply?

To apply for an HSBC World Selection portfolio, you must:

- Be at least 18 years old

- Live in Jersey, Guernsey or the Isle of Man

- Not be a US national, citizen or resident (eg a US passport or Green Card holder)

- Have an HSBC Channel Islands & Isle of Man bank or savings account (not including Fixed Rate Saver or Online Bonus Saver). For joint investments, you'll need a joint bank account in the same names [@open-account-eligibility]

- Invest a minimum of £50 per month or a lump sum of £500, for investments without advice through our International Investment Centre

- Invest £250 per month or £25,000 lump sum, for investments with advice

Ready to invest?

Already with HSBC?

Apply online in just a few minutes. Log on to online banking and select 'My Investments', then 'International Investment Centre'.

New to HSBC?

Open an account with us and register for online banking to apply for an HSBC World Selection portfolio.

Frequently asked questions

You might also be interested in

Additional information

Please remember that the value of investments, and any income received from them, can fall as well as rise, is not guaranteed and you may not get back the amount you invested. This could also happen as a result of changes in currency exchange rates, particularly where overseas securities are held or where investments are converted from one currency to another. We always recommend that any investments held should be viewed as a medium to long-term investment, at least five years.

We may need more supporting information regarding the source of your funds and wealth to meet the due diligence requirements of our local regulator. We'll contact you if this is needed.

This is a non-advised investment service for investors who want to make their own investment decisions. The content on this webpage does not, and is not intended to, constitute advice. Therefore if you trade through this service HSBC Channel Islands & Isle of Man will not assess the suitability of the transactions for you. If you're in any doubt about the suitability of an investment transaction, we recommend you seek financial advice.

Past performance is no guarantee of future performance. It's important that you understand the risks and charges associated with any investment. Before investing, check the specific product literature, including the fact sheets and key investor information documents to compare the risks and charges associated with your chosen funds.

By making investments yourself through our self-execution service, you will not benefit from the additional investor protections and assurances that form part of the benefit of obtaining professional investment advice through our advisory services.

If you are unsure about your personal tax obligation, you should seek independent tax advice. Neither we, nor any member of the HSBC Group, provide tax advice.

KIIDs, Portfolio Factsheets, Prospectus and Annual Report are provided for your information by HSBC Global Asset Management (UK) Limited, which is responsible for their reliability and accuracy.