HSBC now offers a name checking service called Confirmation of Payee (CoP). It aims to protect against Authorised Push Payment scams and reduce the number of payments sent by mistake.

When you make a one-off payment, set up a new regular payment or amend an existing payment, CoP lets you check you're paying the right person or business. That way, you can see if the name matches the details you've been told.

CoP will also check your details when a person or business sends you a payment to see if your name matches your account.

Some institutions require a specific reference number to be entered when making a payment. CoP will also check the details to help ensure you're paying the correct account. Examples where this may be required include:

- A roll number for some building society accounts

- A 16-digit credit card number when paying a credit card bill

For these accounts, when you enter a sort code and account number, CoP will use the reference to ensure the account name is correct. If the details entered in the reference box are invalid or not recognised by the receiving payee Bank, you'll be informed and asked to check the details.

You must ensure that you insert the account holder's name into the payee box instead of the institution name to allow the check to perform correctly. If you enter the incorrect name, you will get a no match. Check with the person or business who is receiving the money to get the correct details.

Not all payment service providers will enable CoP checks on accounts that require a reference. If you're paying one of those accounts, you'll get a message saying we can't check the details.

How does name checking affect payments I'm sending?

We're already responding to requests sent by other banks for payments you're receiving. We're also requesting CoP checks for payments you're sending to other banks.

You'll see this feature whenever you're making payments from UK personal or business accounts.

CoP applies to payments made online, on our mobile app, by phone and in a branch, using faster payments or CHAPs.

It only applies to payments made in pounds sterling.

How does name checking work?

Checks are carried out to make sure the account details you provide match those held by the bank of the person or business being paid.

This applies to new payments and changes to existing payments.

The checks are to confirm the account type (business or personal), the account name and if applicable the reference, match the records held by the recipient's bank.

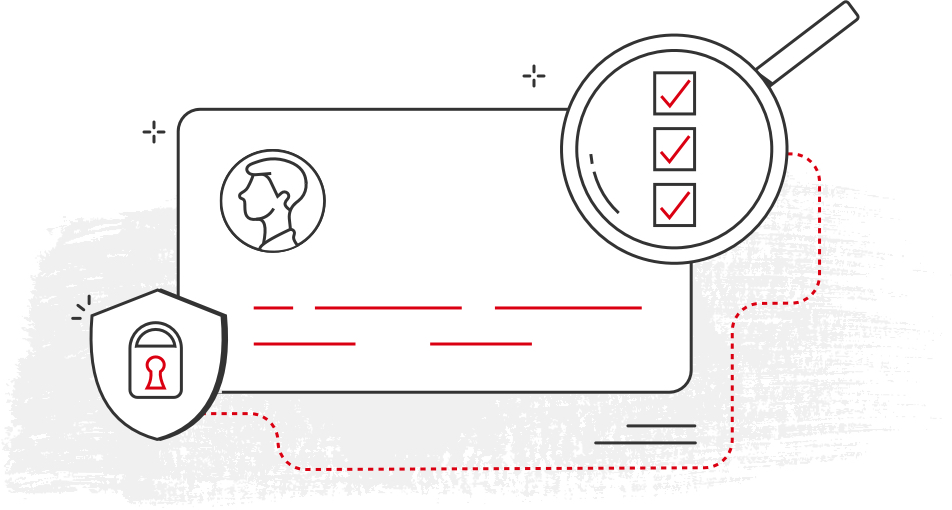

Full match

Sending payment: you've used the correct account type and account name so you can go ahead and make the payment.

Receiving payment: the person sending the payment has used your correct account type and account name so they can make the payment.

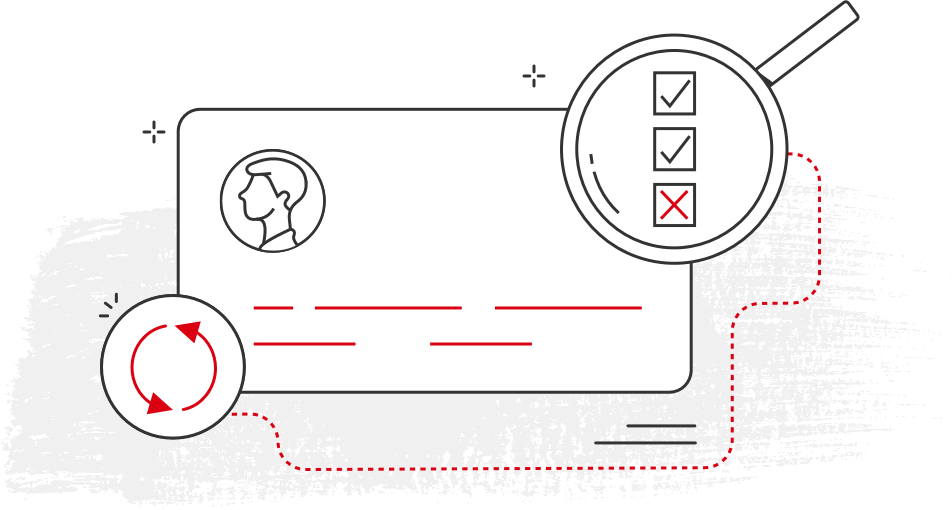

Close match

Sending payment: you've used a similar name. We'll share the actual account name with you and confirm whether or not the account type is correct. You can then decide whether to make the payment or check with the person or business you're paying.

Receiving payment: the person making the payment has used a similar name. We'll share your actual account name with the sender's bank and confirm whether or not the account type is correct for them to pass on to the sender. The sender can then decide whether to make the payment or check with you.

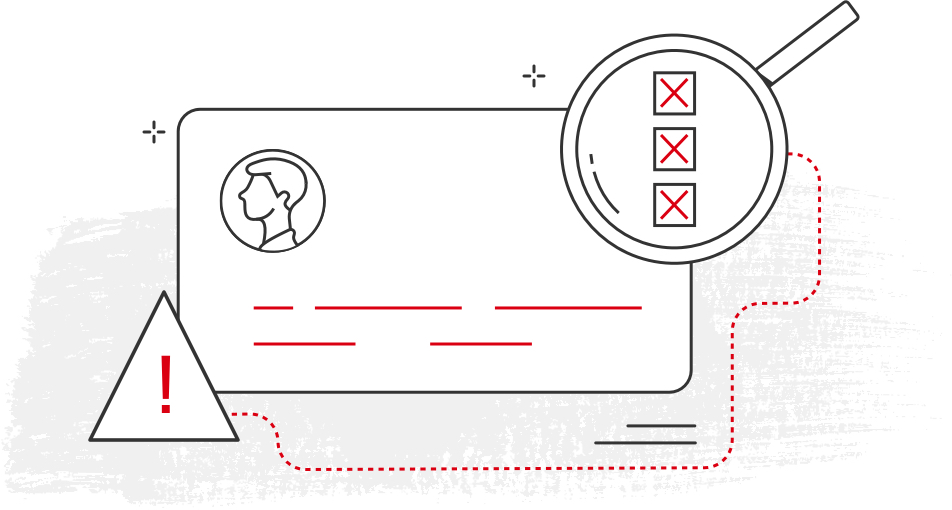

No match

Sending payments: the receiving bank has advised that the details you've entered don't match the name held on the account. You should check with the person you're paying before going ahead - but you can decide to make the payment without checking. If you contact someone you're trying to pay, make sure you call a trusted number that you know is genuine.

Receiving payment: the person paying you can decide to go ahead without checking - so you might receive the payment anyway.

Payee account is not supported/Unable to check name

This means we can't do a Confirmation of Payee check. Either the bank you're sending the money to doesn't do CoP checks, or the type of account you're sending the money to doesn't support these checks. It can also mean that the person you're paying has switched their account to a new one.

There might also be a technical issue which means do a Confirmation of Payee check. You'll see a response saying there's a systems problem and recommending you try again later.

Payee account details are invalid/Account not found

This means the account number and/or sort code are incorrect. In this case, you won't be able to make the payment and should contact the person or business you're trying to pay to get the correct details.

Reference details are invalid/Account not found

The receiving bank has told us the reference entered is not valid. You should check with the person or business you're paying before going ahead. You can make payments without checking, but we don't recommend it as it may be a scam. Always use a trusted number you know is genuine.

Some exceptions

If you do make a payment where there's no exact match, you'll need to accept that your money could go to the wrong account and you may not get it back.

What should I do to help anyone paying me?

Is your account for personal use or for your business?

You can help by telling anyone making a payment to you the account type when you give them your account details. If you're unsure of your account type, please contact us.

Is the name they're inputting correct?

The name we hold for your account might not be the name the person is inputting. For example, they may be inputting Jim but your account name is James or they may know you as Jim the plumber but your business account is in the name of James Smith Plumbing Limited.

If you're not sure, you can check your account by:

- logging on to online banking

- checking your statement on mobile banking

- contacting us

For joint accounts, the full first and last name of either individual will ensure the name check is made.

What is an Authorised Push Payment?

This is when a bank or building society is instructed to make a payment from one account to another without using a debit or credit card. The bank or building society is also known as a payment services provider or PSP.

How do APP scams work?

An APP scam is when a fraudster tricks victims into sending money to someone it's not intended for. Sometimes they send money to someone for what they thought was a genuine purpose, but was actually fraudulent.

Payments related to APP scams can be made over the phone, online or in person and most are completed instantly.

We're working closely with other industry partners to introduce the new CoP service in a consistent way.

Benefits of name checking

The Confirmation of Payee service gives you greater security when you're making payments.

It helps to protect against APP scams, which aim to trick you into authorising a payment to an account you believe is genuine – but is in fact controlled by a criminal.

With name checking, you can make sure the name of the person or business you're paying matches the name held on the account.

Here are some other warning signs which may mean you're being targeted by fraudsters:

- payment requests being received from someone you don't know

- being put under pressure to make a payment

- changes being made to the details on account you're paying

- being asked to continue with a payment even though the details don't match